Auto Insurance App Development: The Ultimate Guide

Vehicle driving can prompt many street mishaps due to human issues. Many minor vehicle strikes happen over the world. So, while purchasing another vehicle, clients become acquainted with in regards to its protection plans. Here's where insurance or in today's tech-driven world, auto insurance app comes into the picture.

Car Insurance is significant in light of the fact that it recoups costs identified with the harm fix. Since these vehicles are costly enough, no one needs to contribute more cash to the fixing service.

On the off chance that you are searching for new extensions to improve your service quality dimension, building up an accident insurance application is an astounding decision for you. The insurance field is encouraging.

Customers look for snappier and more straightforward approaches to applying for the required insurance type or request guarantee preparation.

Furthermore, with the help of the mobile application, they can without much of a stretch do it. So, an accident insurance application development can enable your clients to make their life bother-free.

How Developing An Auto Insurance App Is Beneficial For Your Business?

Building up an insurance application can offer you some important advantages:- You will need fewer staff individuals and can lessen operational expenses. As the mobile application will enable you to speak with individuals all the more capable.

- Mobile users invest the most extreme energy in utilizing mobile applications. While mobile web records are less utilized. Thus, your site can't offer the best outcomes.

- You can lessen the outstanding burden of the backup plans, offering them more opportunities for different employments.

- You can achieve your customers all the more effectively through the auto insurance app. You can offer extra roadside services and protections which cause an expansion in incomes.

- Your business can grow instantly. Through this mobile application, users can get to your services even in the event that you don't have a workspace in their area or city.

Top Features to Include In an Auto Insurance App

While the benefits of an Auto insurance app are evident for your business. You have to consider including a rundown of fundamental features to expand the service level, brand devotion, and contact more spectators.

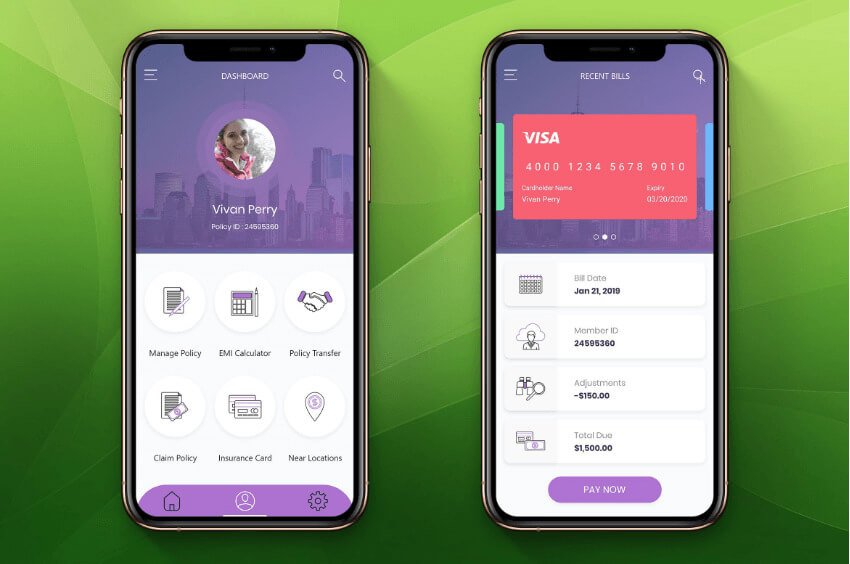

User profile

Ensure you offer simple onboarding in your auto insurance app. The users ought to have the option to make a profile in less time. Since app developers will make insurance applications, offering separate profiles to every user is indispensable.Enable users to get the least value protection

Not all clients wish to spend a major sum on vehicle protection. The greater part of the drivers requests modest vehicle protection arrangements. Ensure that the auto insurance app sorts down the least expensive strategies for clients.Channels

As referenced in the principal point, the vast majority of the driver favor minimal effort insurance. In any case, a few drivers may have various necessities. According to the prerequisites, it is significant for the mobile application development company to offer the best reasonable applications for the clients in the auto insurance app.GPS

A collision protection vehicle must have GPS introduced. It offers ongoing following of vehicles. This framework can be utilized to offer roadside help through your auto insurance app.Analyze various statements

There are various statements according to various necessities. Offer a short examination of everything being equal. This can enable the client to comprehend which statement is appropriate.Enable them to buy protection through the application

After choosing suitable insurance, the client ought to have the option to buy the protection right away.Documentations

The greater part of the auto insurance app designers enables clients to catch the pictures of archives and present those pictures. Since documentation is compulsory, mobile application designers can likewise enable clients to examine the reports for accommodation. Clients need not remain in long lines to submit required archives for protection.Receipt

Give a point by point receipt to the clients. According to the chose statement, the client can get the receipt on the application itself. This makes it progressively helpful. After the effective installments, the application clients ought to get affirmations. Ensure these receipts are in detail and are approved.Asserting

As a rule, guaranteeing protection statements is a tedious undertaking. Drivers need to go to the workplace and fill in certain structures to guarantee insurance. To erase this issue, offer them simple asserting alternatives. Mobile application development company can even enable drivers to transfer pictures to guarantee protection.Pop-up messages

It is imperative to inform clients about application refreshes, forthcoming installment cycles, solicitations, receipts, and so forth. Ensure you send significant in-application notices just as messages.Multi-lingual help

To drive application commitment and increment application maintenance. Building up a multilingual auto insurance app can be helpful. On the off chance that you focus on a total globe, at that point, the application ought to have a multilingual element.Payment Gateways

Payment gateways are the most significant component of insurance applications. Since you are enabling drivers to choose cites, buy protection, and get a receipt; at that point, you ought to permit them simple payment alternatives. It very well may be through charge cards, check cards or even e-wallet applications.

Telematics

This is a cool component. Give us a chance to reveal to you that this component is costly and justified, despite all the trouble. Telematics utilizes man-made consciousness. It utilizes GPS, accelerometers and whirligigs information on the cell phone.

This information is utilized to assess drivers' driving abilities. An acclaimed application called Root utilizes telematics. The driver should give test drives for a range of about fourteen days. In this range, the application recognizes driving practices and examples. It dissects various things, for example, drivers' incessant goals, use of the cell phone while driving, the complete time the vehicle is being used, how frequently drivers move to another lane, do they pursue traffic rules, and so forth.

This information is utilized to assess driving abilities. In the event that the driver drives safe and qualifies by all means, he gets the chance to pay less sum for collision protection. Since there is a generally safe of mishaps and harms, the application offers modest collision protection approaches.

Client support

Since you are going to begin a protection startup, it is fundamental to concentrate on client support. Ensure you offer 24×7 client support for the improved client experience in the auto insurance app.Conclusion

Being a car insurance startup, if you are having an auto insurance app idea, at that point, you can cross-check it with us as we are the main mobile application development company.

And have created more than 100 mobile applications alongside various highlights and functionalities.

In the event that, on the off chance that despite everything you have any question or perplexity in regards to application development cost of car insurance app, the normal expense of building up an application, how to profit with an application thought, Indian application developers cost, at that point you can connect with us through our get in touch with us structure. One of our business agents will return to you at the earliest opportunity.

.png)