Top 10 Factors For Choosing Custom Payment Gateway For Your Business

Whether you're a startup or an established firm, the big question, "How can I get money from my customers?" remains dormant at the initial online business setup phase. You want to provide a secure, rapid, and easy-to-use payment system to your customers via custom payment gateway, whether you manage an eStore or simply maintain an online presence.

The payment method you choose must meet the needs of both your customers and the company. As a result, it must support a wide range of payment methods, be simple to use, and work with your platform. The payment gateway you use must protect your transactions from fraud, as smart hackers are popping up every day. A trustworthy and secure gateway for payment will provide the best protection for transactions between your business and your clients. The currencies you can accept, the transaction fee, how quickly money arrives in your merchant account, and the payment methods you'll offer are all determined by the custom payment gateway of your choice.

What is a Payment Gateway?

A Payment Gateways are the application service provider that authorizes digital payments from multiple channels for online businesses, merchants, and traditional brick-and-mortar stores. They're the ones who link the merchant's and customer's accounts, and then authorize payments. Between users and payment processors, it serves as a go-between. To ensure the security of transaction data, it employs security protocols and encryption. Data is transmitted back and forth from payment processors/banks to websites/applications/mobile devices.

Accepting various sorts of electronic payments becomes simple with the help of an online custom payment gateway provider. This will make the buying process for customers easy, legally foster customer trust, provide multiple payment alternatives, and give you access to global transactions.

Online payment gateway services provide a complete all-in-one solution for businesses, eliminating the need for you to set up and run all of the software, hardware, connections, and security.

The following transaction types are supported by these custom payment gateways:

- Authorization: It is a sort of transaction that determines whether a consumer has the funds to pay. For orders that take a long time to ship or build, an authorization transaction is used.

- Capture: The actual processing of a previously authorized payment that results in funds being remitted to the merchant's account.

- Sale: It's a transaction that combines authorization and capture.

- Refund: The outcome of a canceled order, for which the merchant must use refund payment processing to repay the funds.

- Void: Identical to refund, but only possible if funds haven't been captured yet.

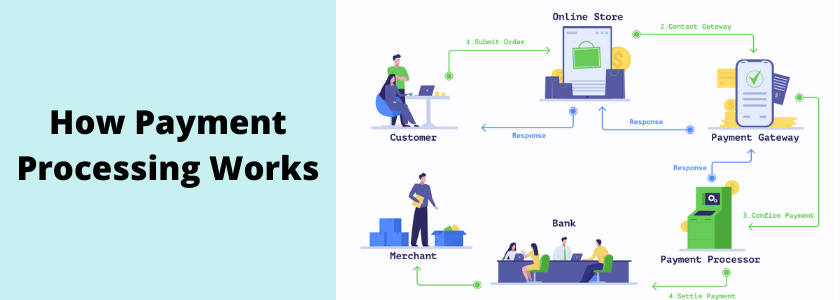

How Payment Processing Works

The goal of gateways for online payment is to make payment processing more efficient, secure, and convenient. Rather than sending payments, it approves the amount transferred to the seller and does so safely and securely for the buyer. Here is how the processing works and the whole process takes no more than a few secs.

Step 1: A customer makes an online transaction, the payment gateway "swipes" their credit card.

Step2: The data to be communicated between the web browser and the merchant's web server is encoded by the web browser, which then transfers the key information (name, card number, CVV) to the payment processor.

Step 3: The transaction data is sent to a card affiliate (such as VISA), which then verifies its authenticity.

Step 4: The issuing bank accepts or denies the transaction when authorization is accepted, and this information is sent back to the payment processor.

Step 5: When the gateway receives this response, it sends it to the site/interface for payment processing.

Step 6: The money is "accepted" by the merchant's bank, and it begins the process of being transferred to their account.

A Checklist For Choosing The Right Payment Gateways

Now, select a payment option for your business that takes into account all of the elements, as well as the characteristics of your business and your clients. Here are some things to consider while choosing the right custom payment gateway with the help of web application development companies:

1. Select an Appropriate Payment Flow

Your custom payment gateway should be able to scale with your company as it grows. Choose a site with a built-in payment for that

- Sends data to a secure payment gateway.

- For payments, use an iFrame or a redirect.

- A safe escrow mechanism embedded into your e-Commerce web app platform can withhold cash until the appropriate authority is granted by the admin.

2. Examine the Pricing

A custom payment gateway, like any other business, charges a fee for using third-party technologies to process and authorize transactions. Fees are charged by all parties involved in payment verification/authorization or processing.

Each payment solution company has its own set of conditions and costs. Typically, you'll encounter the following cost types: A startup cost, a monthly gateway fee, a merchant account setup fee, and a fee for each transaction performed are all included in the gateway setup fee.

3. Know the Security Factors

Make sure you understand the security factors—both what they offer and what you require as a merchant—before signing with any custom payment gateway for online business.

4. Check Transactions Effectiveness and Limits

Make sure your customers can make a purchase easily and successfully. For this you can also enhance your checkout experience with software development company. This is true for every step of the buying process. While fees and installation costs are unavoidable, a transaction fee may affect whether or not you can work with a particular provider. Check the transaction restrictions specified by gateway providers as a minimum and maximum amount. The second point to consider is the daily or monthly transaction restrictions.

5. Make Checkout Simple on Every Device

Make sure you can deliver a working checkout experience that is responsive to various mobile devices and network types when you assess your custom payment gateway alternatives.

6. Have Multiple Features to Choose from

Depending on your business demands, custom payment gateway service providers offer a variety of options. Your payment gateway should offer a global solution, accepting a variety of credit cards, debit cards, and currencies from various nations. Check to see if your chosen payment gateway offers electronic invoicing, all payment methods, customer text/email reminders, smart chargeback management, and other features.

7. Check merchant account options

A merchant account is an agreement between a business and an acquiring bank that allows the bank to process the business's transactions. To receive funds through an online payment system, examine the options available for a merchant account. For both sellers and consumers, merchant accounts add an added degree of protection and money management.

8. Is it hassle-free, and offers a great UX?

Make sure that transferring systems does not cause any friction or confusion among your present consumers. Know if the custom payment gateway is easy to use, navigate and make seamless transactions.

9. Easy Integration

When deciding which gateway of payment to use, one of the most significant considerations is how well it integrates with your existing technologies. The optimum option is to use a payment gateway system that does not degrade the user experience of your website by requiring a lengthy payment process. Know if the payment gateway will work with your inventory management software or financial software, etc.

Custom Payment Gateway Integrations will provide you with numerous benefits.

10. Good Customer service (24*7)

Several custom payment gateway firms offer only ticket or email assistance. In this case, users must follow manual instructions to resolve an issue. Check whether the company offers live technical help if you prefer talking to someone rather than sending emails.

Benefits of Custom Payment Gateway Integrations

Improved Customization

Develop a precise feature to enhance your operations and create a payment experience that genuinely meets your business needs. In terms of the payment experience of existing gateways, merchant gateway providers only provide a limited number of options. A custom payment gateway solution is created specifically for you and can be fine-tuned to match your billing cycles and financial operations.

Integrations with Payment Gateways with a Broader Scope

While developing your web application, create a custom API to integrate your payment gateway into any sort of product, including desktop, mobile, and web apps, wearables, digital kiosks, smart vending machines, and connected automobile onboard computers. You can connect your merchant account with a Cloud ERP system, accounting, and payroll software, etc.

Lower Transaction Processing Fees and Total Cost of Ownership

Most custom payment gateways have transaction fees that vary depending on the payment method and region of your clients, as well as your monthly turnover/transaction volume. While a custom payment gateway system is more expensive to develop, it can save you money in the long term.

Innovative Security

Payment gateway solutions do not have a high rate of data breaches because most providers invest extensively in security. With a custom payment gateway, your IT security team has complete control and visibility over all payment end-points, making breaches less likely. Furthermore, you can use biometrics to develop more complex customer authentication techniques.

Compliance

Businesses in highly regulated industries may not be able to obtain an appropriate payment gateway provider on the regular provider list. It's not easy to create a custom payment processor that complies with PCI DSS, PSD2, and any other local standards. With a custom payment gateway, you do have more control over how each component is created, how sensitive data is processed and kept.

Popular Payment Gateways For Online Businesses

Checkout on-site, payment off-site

Checkout on-site, payment off-site refers to a merchant's ability to complete purchases on-site using technologies such as Stripe on their digital commerce site. The user will think they're checking out right on your website, but the payment is initiated, transferred, and accepted by the processor on the backend. It's a painless and speedy procedure.

Redirects

Redirects function just as the word implies. It instantly redirects a customer away from your website and to another one. When a customer goes to check out on a merchant's website, they are given the option to pay through a third party, such as PayPal or Apple Pay, to complete the transaction.

Payments Made On-Site

On-site payments are done directly on the merchant's website, with no third-party participation in the backend. With this custom payment gateway, the merchant has complete control over the checkout process and user experience. With the control, they also get the obligation of getting compliant and keeping up to date on all security measures to prevent data breaches and leaks.

Best Payment Gateways

- Paypal

- Stripe

- Authorize.net

- 2Checkout.com

- Instamojo

- Square

- Apple Pay

- Amazon Pay

Wrapping Up

So, whether you're a non-profit business, picking a custom payment gateway/processor provider or building your payment portal is always a lot more profitable alternative for an online retailer.

Customers are more likely to trust websites that provide a built-in payment system. Contact our experts to help you build an effective Custom Payment Integrated Gateway for your businesses.